Sydney’s median price is now a staggering $1,601,467 and house prices surge almost $1100 a day, but the market may have peaked

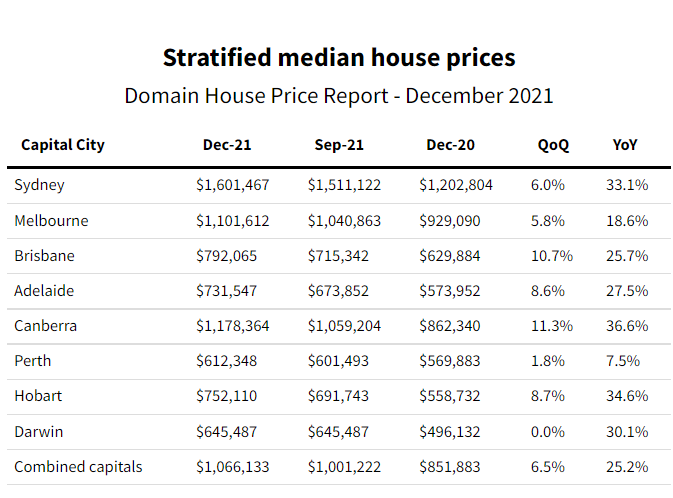

The median price for a house in Australia has soared past $1 million as capital city prices rocket to record levels, according to new research, putting housing affordability firmly back in the spotlight.

Ultra-low interest rates continued to drive buyers to the property market right through to the end of 2021, and coupled with a lack of supply, pushed house prices up to eye-watering levels in nearly every capital city, the latest Domain House Price Report, released on Thursday, shows.

Nationally, house prices rose 25.2 percent in 2021, and six out of the eight capitals hit record house prices during the December quarter.

Sydney house prices have hit a record median of $1.6 million, new figures show, after climbing almost $1100 a day in 2021.

Greater Sydney house prices skyrocketed by 33.1 per cent – almost $400,000 – last year, climbing 6 per cent in the final quarter alone to a median of $1,601,467, Domain’s Quarterly House Price Report reveals

It’s the steepest annual increase since Domain records began in 1993, with house prices in half a dozen regions rising more than $500,000.

Unit price growth was more subdued but still rose 8.3 per cent annually – and a marginal 0.9 per cent last quarter – to a record high of $802,255.

Domain’s chief of research and economics Dr Nicola Powell said house prices had grown roughly four times faster than unit prices over the year, creating a record gap between the two – with houses now twice the price of units.

“The rapid escalation in price is proving to be a significant financial barrier to entry for buyers and upgraders against a backdrop of low wage growth,” Dr Powell said.

It’s the steepest annual increase since Domain records began in 1993, with house prices in half a dozen regions rising more than $500,000.

Unit price growth was more subdued but still rose 8.3 per cent annually – and a marginal 0.9 per cent last quarter – to a record high of $802,255.

Domain’s chief of research and economics Dr Nicola Powell said house prices had grown roughly four times faster than unit prices over the year, creating a record gap between the two – with houses now twice the price of units.

“The rapid escalation in price is proving to be a significant financial barrier to entry for buyers and upgraders against a backdrop of low wage growth,” Dr Powell said.

Commonwealth Bank Head of Australian economics Gareth Aird said Sydney’s phenomenal price growth, particularly for houses, not only highlighted the impact of incredibly low interest rates but were also due to the pandemic.

The price disparity between houses and units showed the premium people were now prepared to pay for more space, and also reflected the increase in demand for outer suburbs and regions, where units were fewer, he noted.

“As much as interest rates have had a massive impact on property prices, I think it’s COVID-related issues, particularly the changing work from home environment and people spending more time at home, that has put a premium on houses,” Mr Aird said.

Price growth would be more subdued in 2022, he predicted, having previously forecast another 7 per cent growth, with prices to peak in the second half of the year.

However, with Mr Aird and other economists now expecting the Reserve Bank to hike interest rates in August, due to strong inflation, a lower unemployment rate and signs of wage growth, the market was probably getting towards its top now, as a rate hike would impact how much buyers were willing and able to borrow. The rise in fixed interest rates, already underway, would also impact the flow of credit and weigh on prices, he added.

Westpac senior economist Matthew Hassan said Sydney had seen spectacular growth but prices were likely to moderate and even fall by the end of the year as interest rates rise. Westpac increased its fixed rates for owner-occupier and investor loans last week and has predicted an August cash rate rise of 15 basis points.

Affordability limitations would also be causing issues for first-home buyers and those looking to get back into the market, Mr Hassan said, easing buyer demand. Short bursts of sharp price rises were generally followed by a longer period of stabilisation, he added.

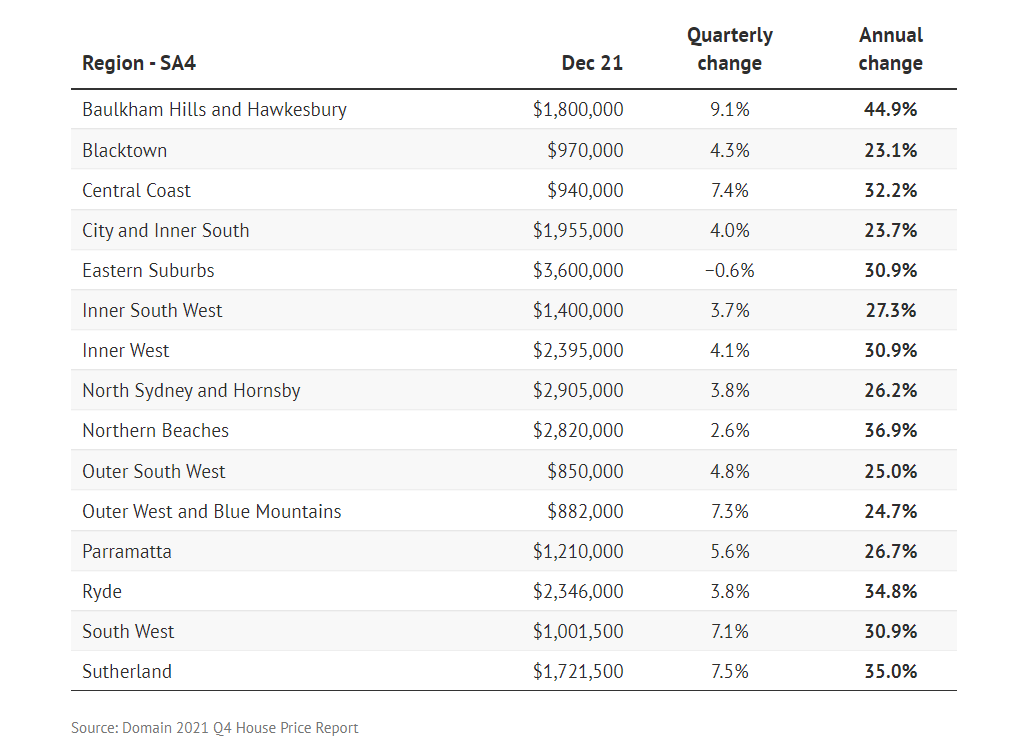

Dr Powell said the Sydney market had already shifted, with the total number of homes for sale rising and prices at the top end of the market – which typically lead price cycles – pulling back slightly. The eastern suburbs median was down 0.6 per cent over the quarter to $3.6 million, while the northern beaches had the second lowest quarterly growth at 2.6 per cent.

Median house prices across Sydney

Weaker growth across the two regions, which had been standout performers during the pandemic, showed conditions were easing, Dr Powell said.

That weakness would ripple out across the city in the months to come, just as prices rises had – with outer or more affordable areas such as Baulkham Hills and the Hawkesbury, Sutherland, Central Coast, Outer West and Blue Mountains recording the strongest growth last quarter.

The market shift was welcome news for house hunters such as Anton and Nicole Kastner, who bought their first family home, a four-bedroom duplex in Kingsgrove, in mid-December, after about a year watching the market and many years of saving.

“It was always a bit disheartening, especially when you talk to agents and they say a property will go between $800,000 and $1 million and you think ‘okay we could probably do that’, then at auction it ends up going for $1.3 to $1.4 million,” Mr Kastner said.

They bought quicker than expected when they started pro-actively searching, with the help of buyer’s agent Hamada Alameddine of Buyer X, but still had to make compromises along the way, having started their house hunt in the inner west. The sale of an Adelaide unit, and some help from family – who offered discounted rent – was also key.

“We were lucky enough with the property we got, we can quite easily be in there for 10 to 15 years, but understood if we went closer to the city [our family] could only be there for two or three years. Once you start looking, there are obvious compromises you have to make,” he said.

Mr Alameddine said the increase in homes for sale had given buyers more choice and reduced the fear of missing out, but noted A-grade homes were still seeing strong competition. However, he said buyers were becoming more worried about interest rate rises and were more reluctant to stretch to their maximum budget.

Figures quoted are based on Domain data from its Quarterly House Price Report, released January 27. CoreLogic has Sydney’s median house value at $1,374,970 by December, using a method that measures the value of the specific housing market based on the attributes of properties that are transacting, such as land size or number of bedrooms, instead of calculating a stratified median price based on sales, as in the Domain data.